Businesses and consumers are growing accustomed to innovative types of loans like BNPL, working capital, cash advances, and loans secured by assets like cryptocurrency. However, many lenders can’t offer these newer loan types because the limitations of legacy ledgers or issuer processors are holding them back.

Many lenders, especially smaller banks and non-bank lenders, rely on third-party providers to design and launch their loan products. Legacy providers like Fiserv and Jack Henry often have inflexible ledgers that limit the lender’s ability to define how these products should work. Even some newer systems can’t always provide the flexibility needed to design innovative products.

In this article, we’ll discuss how legacy systems are hindering lenders from developing loan products that the market demands. We’ll also demonstrate how they can overcome these limitations by augmenting their legacy systems with “side ledgers” that enable new product types, without requiring them to rip and replace their existing ledgers.

The limitations of legacy ledgers and issuer-processors

At Canopy, we’ve encountered numerous lenders who are “boxed in” by the capabilities of the vendors they work with. The primary issue is a lack of flexibility. Many of these vendor systems were built for an older era that was defined by a standard of product that no longer fits today’s world.

Lenders using these systems are stuck with “off-the-shelf” products that lack modern features. For example, they may want to offer a revolving credit card with dynamic interest rates based on merchant categories, but they can’t because the ledger does not allow it. Or perhaps they want to create a more flexible loan product that blends a line of credit with installment payments, but the issuer-processor does not support it.

Both of these might be considered “edge cases” by legacy systems, but these types of flexible products are becoming the new standard. Yet, they are often beyond the technical abilities of legacy systems.

Lenders, especially smaller or non-bank lenders, need innovation to compete in the modern marketplace. Customers expect flexibility and convenience, and are increasingly seeing more innovative loan options with the rise of embedded SaaS lending and BNPL. If a lender lacks the core capabilities to create these types of products, the market may leave them behind.

The legacy ledger’s sunk cost

At the same time, many lenders are resistant to change, especially when it comes to their ledger. They’ve invested too much time and energy into their existing ledger to throw it out, and building a new one seems like a massive undertaking. However, there is another approach where lenders can maintain their legacy ledger and develop new and innovative products alongside it on an alternative ledger.

Why augmenting your ledger is better than replacing it

The solution to these limitations is to augment your ledger, rather than replace it. Instead of ripping out your core infrastructure, you add a flexible side ledger that works alongside your legacy ledger. Your new ledger is the enabler for the innovative products you want to develop, as it has advanced features and data management capabilities. At the same time, your legacy ledger continues to support your original lending products without disruption.

This second, or “side ledger,” is now your source of truth for specific products. This could be your revolving credit card program, BNPL, merchant cash advance, or other new type of loan product that your market demands. With a side ledger, you avoid constantly reconciling the primary ledger, as you don’t need to mix the two.

This middle ground is a pragmatic solution to a problem that is plaguing many lenders who want to innovate but can’t due to legacy solutions. Most likely, their primary ledger continues to handle the bulk of their portfolio, but they’re able to open up new markets with the side ledger. It’s the best of both worlds.

To some in the industry, this model has been referred to as a “shadow ledger” or a “hot backup”. Sometimes, having a backup ledger provides more than just new capabilities; it also offers assurance to capital providers that lenders have the business continuity they need to comply with their standards.

→ Learn more about alternative ledgers (aka “hot backups”) in our guide: Why alternative ledgers are on the rise.

Four capabilities ledger augmentation unlocks

By adopting this ledger augmentation strategy, rather than a rip-and-replace approach, lenders can unlock these four key capabilities.

1. Test and launch flexible products

Using a side ledger enables you to test innovative products with new capabilities that your legacy ledger won’t allow, such as hybrid loans that combine installment payments with revolving credit.

Once tested, these products can be launched on the side ledger without disrupting the core system for legacy products. This enables lenders to respond more quickly to market demands and reduces engineering costs.

2. Customize payment terms

Many lenders, especially embedded lenders, cater to specific industries, such as retail, restaurants, or e-commerce. Industry-specific lenders can stand out by offering credit products with lower rates for everyday purchases within their respective industries. For example, a restaurant lender could offer a credit card with lower rates for bulk purchases of groceries or restaurant supplies.

However, legacy ledgers often don’t allow for this level of customization. Using a side ledger that enables specific interest rates for different merchant categories enables lenders to create industry-specific products without modifying their existing ledger.

3. Add flexibility for complex scenarios

Many legacy systems are unable to make modifications for “non-happy path” scenarios, such as when a borrower needs a temporary payment pause or loan restructuring for lower payments over a longer period.

Alternative ledgers can be built with complex scenarios in mind to create “flexible servicing”, where payment terms can be modified on the fly. This is especially helpful in industries where cash flow fluctuates seasonally but remains strong over a longer time frame, such as tourism.

4. Building a shadow ledger for capital provider compliance

Some capital providers require lenders to have third-party verification (i.e., double-checking) that the data in their ledger is accurate. A backup or “shadow” that mirrors the original ledger, reconciles loan data against it, and fulfills the requirement for “third-party verification”.

A side ledger can provide this capability alongside the ability to create new and more innovative types of products and handle more complex scenarios.

Build vs buy: How to set up your side ledger

Building a side ledger with new capabilities from scratch can become complex and expensive, and risks creating the same problems lenders are trying to escape with their legacy ledgers. Partnering with a lending platform that already has the capabilities you need is a faster and easier way to explore and launch innovative new products.

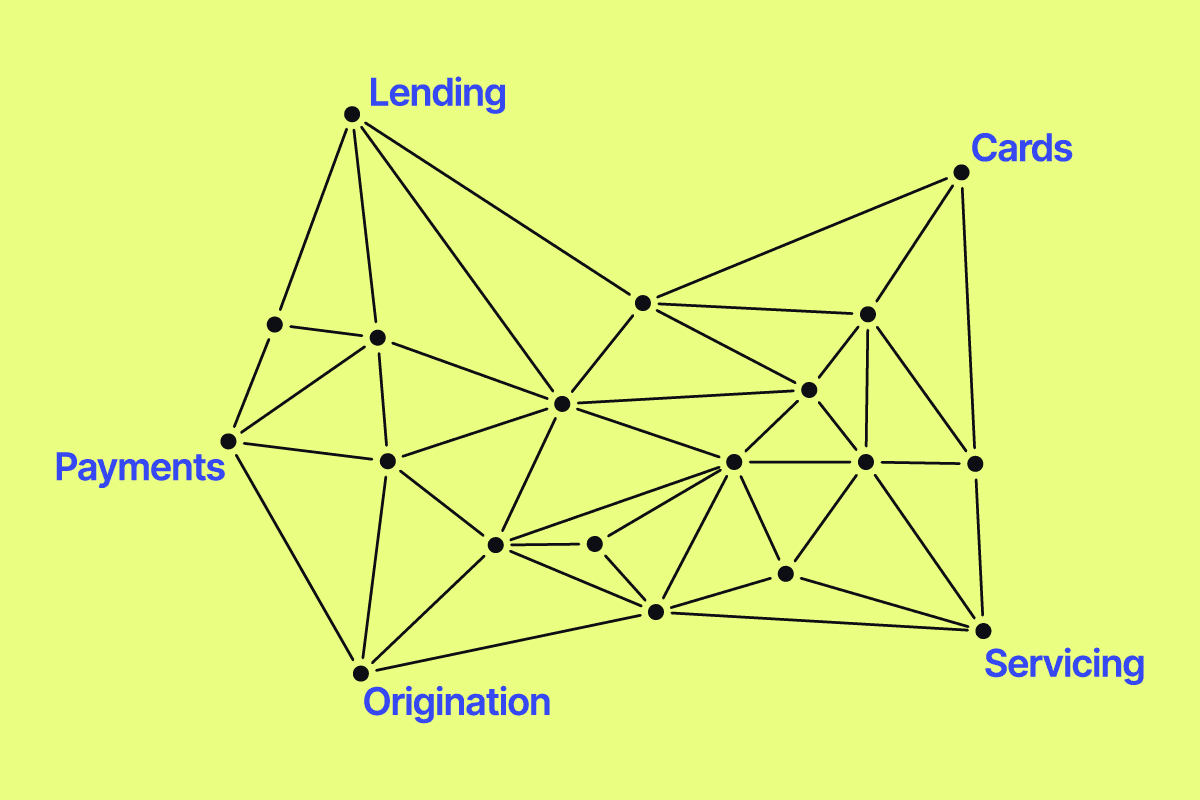

Systems like Canopy OS have an API-based infrastructure that connects every part of the lending process, enabling new capabilities such as invoice factoring, variable interest rates, working capital loans, and more. Lenders can utilize Canopy’s flexible building blocks to respond to market needs by quickly testing and launching new products.

Interested in trying out innovative new products without disrupting your existing ledger? Reach out to Canopy to learn more.